07 March 2023Climate Change, Publications, Risk, TCFD

POPULAR CONTENT

07 March 2023Climate Change, Publications, Risk, TCFD

17 May 2022Events, Roundtables

19 December 2023Banking, Climate Change, Insurance, Investment, Nature, News, Policy, Pollution & Circular Economy, SDGs and Impact, Social

Nature, News | 19 September 2023

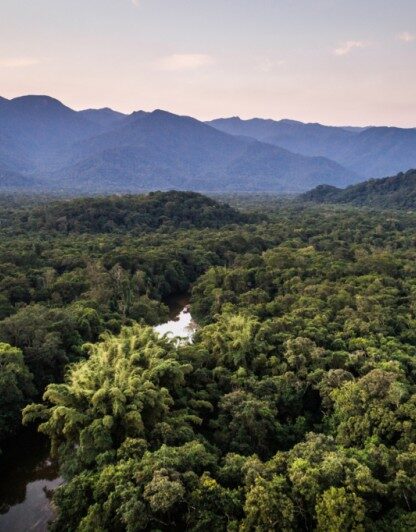

The Taskforce on Nature-related Financial Disclosures (TNFD) released its final recommendations today. This is a historic moment to encourage and support action on nature. The groundbreaking framework enables companies to assess, disclose and manage nature-related risks and impacts which will lead to consistent and comparable reporting on nature-related risks and impacts by businesses and financial institutions, worldwide. In this article, we explain the role of UNEP FI and our members in developing this innovative tool and outline how financial institutions can get involved.

Blue Finance, Nature, News | 06 September 2023

The International Finance Corporation (IFC), a member of the World Bank Group, together with the International Capital Market Association (ICMA),…

Climate Change, Nature, News, Policy, SDGs and Impact, Social | 04 September 2023

4 September 2023 – Following its response to the IFRS consultation on the ISSB’s first standards – General Requirements for…

News | 31 August 2023

Find out more about UNEP FI's presence at the world's largest climate-focused event - 2023 Climate Week in New York.

Asset Owner Alliance, Climate Change, Investment, News | 29 August 2023

The Net-Zero Asset Owner Alliance launches a public consultation on the fourth edition of its Target Setting Protocol. The updates in the draft of the fourth edition concern expansion of asset class coverage. The public is invited to submit their feedback by 29 September.

Investment, News | 11 July 2023

The Investor Agenda updates the Investor Climate Action Plans (ICAPs) Expectations Ladder, intended to help investors act on climate by providing a single, comprehensive framework that draws on existing initiatives and guidance.

News, SDGs and Impact | 03 July 2023

Recent years have seen accelerated uptake of sustainability-related standards and practices. Enterprises, investors and financial institutions are increasingly paying attention…

By Vanesa Rodriguez Osuna, Food Systems Lead at UNEP FI Food systems are key to achieving the Sustainable Development Goals…

Asset Owner Alliance, Climate Change, Industries, Investment, News, Themes | 13 June 2023

Net-Zero Asset Owner Alliance Chair, Günther Thallinger, argues that responding to climate change is essential for asset owners to fulfil their fiduciary duty and that in order to do so effectively, collaborative efforts are needed.

New guidance has been launched to help financial institutions and businesses gain a holistic view of how dependent they are…