Since the Inaugural Target Setting Protocol in 2021, the Net Zero Asset Owner Alliance has envisioned robust targets based on science from all members. Formulating sector targets constitutes a crucial aspect of the Alliance’s target-setting approach. Constituting USD 10.6T and 74 members globally, the Alliance believes that sector targets are invaluable tools for financial institutions to achieve real greenhouse gas (GHG) emission reductions, as they can incentivise capital provision towards companies which are the best carbon performers within their sector.

However, sector specific data from companies in the real economy remains insufficient, unreliable, incomparable, or non-existent. As a result, investors are not able to fully steer investment portfolios in line with sector decarbonisation pathways or to set science-based targets at the sector level. Recent regulatory consultations—by the International Sustainability Standards Board (ISSB) and the European Financial Reporting Advisory Group (EFRAG)—have also highlighted the importance of access to sector-specific data.

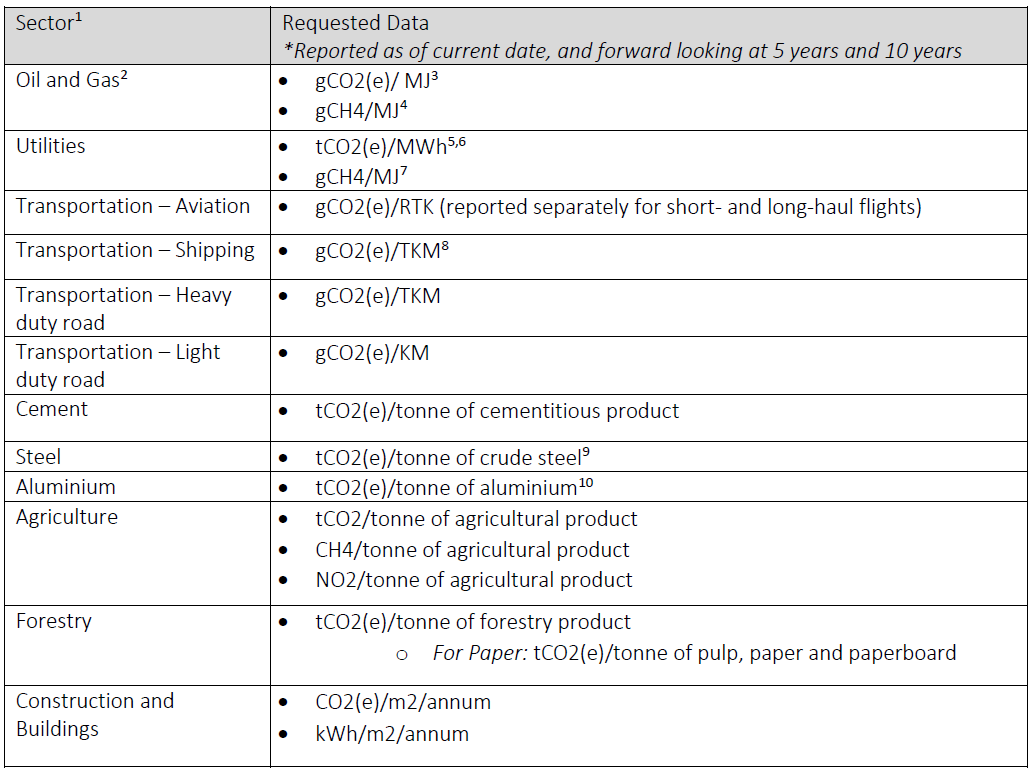

Therefore, with a view to staying invested in and providing capital to transform even the hard-to-abate sectors, the Alliance urgently calls on all real economy companies in the following sectors to prepare and transparently disclose forward-looking decarbonisation transition plans in line with disclosure frameworks such as the Task Force on Climate-Related Financial Disclosures (TCFD), ISSB, and EFRAG. In particular, we call on companies to provide current data as well as forward-looking guidance, including five- and ten-year targets. The Alliance also calls on data providers to support the collection and dissemination of the following metrics.

We call on all companies to begin to disclose the aforementioned data as soon as possible. Alliance investors encourage companies to report annually on progress using these KPIs; this data can be provided through companies’ TCFD disclosures, sustainability reports, and/or through other data providers.

We call on all regulators and policymakers to begin to explore the inclusion of the above metrics in relevant policy. We call on all global net-zero initiatives (Race to Zero, GFANZ, and beyond) to continue to support this and other calls for transparency and data availability. We welcome others to endorse this call or issue similar requests.

About the UN-convened Net-Zero Asset Owner Alliance

The 74 members of the UN-convened Net-Zero Asset Owner Alliance have committed i) to transitioning their investment portfolios to net-zero GHG emissions by 2050 consistent with a maximum temperature rise of 1.5°C above pre-industrial levels; ii) to establishing intermediate targets every five years, and iii) to regularly reporting on progress. The Alliance is convened by UNEP’s Finance Initiative and the Principles for Responsible Investment (PRI). The Alliance is supported by WWF and Global Optimism. Further information on the Alliance can be found here https://www.unepfi.org/net-zero-alliance/

- Please see Alliance Target Setting Protocol Annex for NACE/GICS/BICS mapping of sector classifications.

- It is noted that 2020 was an exceptional year for the O&G and other industries and this particular year should be carefully considered and accounted for if used as a base year for target setting.

- Scope 1, 2 and 3 (use of sold product) greenhouse gas emissions from energy products sold externally in units of grams of CO2 equivalent (gCO2e) per mega joule (MJ). “Energy products sold externally” is defined by the Transition Pathway Initiative (TPI) as the total net calorific energy supply from all fuels including hydrocarbons, biomass and waste, plus energy supplied as electricity generated from fossil fuels, nuclear or renewables.

- The Alliance encourages all relevant companies to join the Oil and Gas Methane Partnership (OGMP2.0).

- Metric tonne is indicated by “t”. “CO2e” is used here and is requested by some, while TPI requests “Co2”.

- Scope 1 of owned gross electricity generation, excluding purchased electricity.

- The Alliance encourages all relevant companies to join the Oil and Gas Methane Partnership (OGMP2.0).

- Please note that current TPI methodology considers emissions related to marine shipping in international waters only. We believe that it would be useful for companies to provide an intensity for all shipping activities and disaggregate these measures by international, coastal, and inland waters.

- Where possible reporting separately for primary and secondary.

- This should include emissions from alumina and aluminum production, both normalised to a tonne of aluminum.