07 March 2023Climate Change, Publications, Risk, TCFD

POPULAR CONTENT

07 March 2023Climate Change, Publications, Risk, TCFD

17 May 2022Events, Roundtables

19 December 2023Banking, Climate Change, Insurance, Investment, Nature, News, Policy, Pollution & Circular Economy, SDGs and Impact, Social

Net-Zero Asset Owner Alliance Chair, Günther Thallinger, argues that responding to climate change is essential for asset owners to fulfil their fiduciary duty and that in order to do so effectively, collaborative efforts are needed.

Singapore's OCBC bank has announced its latest decarbonisation goals, under which it will stop financing upstream oil and gas projects that received approval for development after 2021.

A new project to align the Costa Rican financial sector’s financial flows with the climate change objectives of the Paris…

The Net=Zero Asset Owner Alliance Chair – Guenther Thallinger – has written to the G7 Finance Ministers, urging them to call for a reform of multilateral development banks and development finance institutions.

For investors to address systemic risks posed by climate change, they must focus on systematic solutions and use multiple levers…

A new project to align Panama’s financial flows with the climate change objectives of the Paris Agreement has just launched…

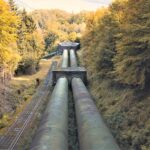

The Net-Zero Asset Owner Alliance publishes its Position on the Oil and Gas Sector, setting new requirements for members and formulating key expectations for oil and gas companies (produces and consumers) and policymakers.

The Emerging Markets Transition Investment (EMTI) project, supported by the Net-Zero Asset Owner Alliance, released a second paper in its Code Red! Series. The paper outlines guiding principles for responsible and effective engagement in emerging markets and developing economies.

Opening remarks to the Net-Zero Asset Owner Alliance-hosted roundtable discussion at the Munich Security Conference by Günther Thallinger, Chair of…

As the global framework and gold standard for Sustainable Banking, the Principles for Responsible Banking need to continuously evolve in line with increasing ambition and new goals humanity defines. Signatories have made the important decision to strengthen the definition of the Principles’ climate ambition to specify that Signatory Banks, in accordance with the Paris Agreement, are expected to align their portfolios with a 1.5 degrees pathway.