The Challenge

The natural world – our forests, soils, land and ocean and the animals and plants within them – provide humans with everything we need to survive. Nature provides our raw materials, such as wood, minerals and food, as well as a range of services such as pollination, water purification, and climate regulation. We cannot get these benefits from individual species alone – we need a range of plants and animals to work together in a living fabric – in other words, we need biodiversity.

The businesses that we finance, invest in and insure rely on nature for their production needs and supply chains. Indeed, it is estimated that more than half the world’s GDP, 44 trillion USD of economic value generation, is moderately or highly dependent on nature – which is increasingly under threat. Globally, biodiversity is declining at an unprecedented rate, with an estimated 1 million species threatened by extinction and for 3 years running (2020-2022), biodiversity loss has been identified by the World Economic Forum’s Global Risk Report as among the top 5 risks by impact. We need to urgently protect, rebuild and replenish and sustainably use and manage natural resources in order to achieve the UN Sustainable Development Goals and the Paris Climate Agreement.

Investing in Nature

In December 2022, the UN brought member states together to ratify the Kunming-Montreal Global Biodiversity Framework, accelerating action worldwide on nature-positive action, which will aim to increase conservation, rebuilding and repleneshing of the natural world. UNEP FI has been working with the Convention on Biological Diversity helping to set the enabling environment for aligning finance to nature, ensuring that the framework includes provision to redirect financial flows across the global economy towards nature-positive solutions.

The global financial sector can and should play a decisive role in halting and reversing biodiversity loss by integrating biodiversity considerations into their risk assessments, decision-making and policies, and aligning their business strategies with the objectives of the Global Biodiversity Framework. Nature and climate are intrinsically linked and financial institutions can take an itegrated approach to these crises. Indeed, climate change is one of the five major drivers of the global loss in biodiversity. Is estimated that if we invest in nature, restoring and protecting key ecosystems can provide over a third of the global emissions reduction the world needs by 2030.

Get Started

UNEP FI works with banks, insurers and investors at the cutting edge of this topic, building capacity, tools and ambition and accelerating action. In partnership with the financial community, we bring science-based, robust guidance, helping to align portfolios and strategies to a nature-positive future, enabling you to identify your business risks and impacts on the natural world. We encourage financial institutions to show their leadership and engage with UNEP FI to tackle this issue with pace and urgency and join the race to rebuild and replenish the natural world.

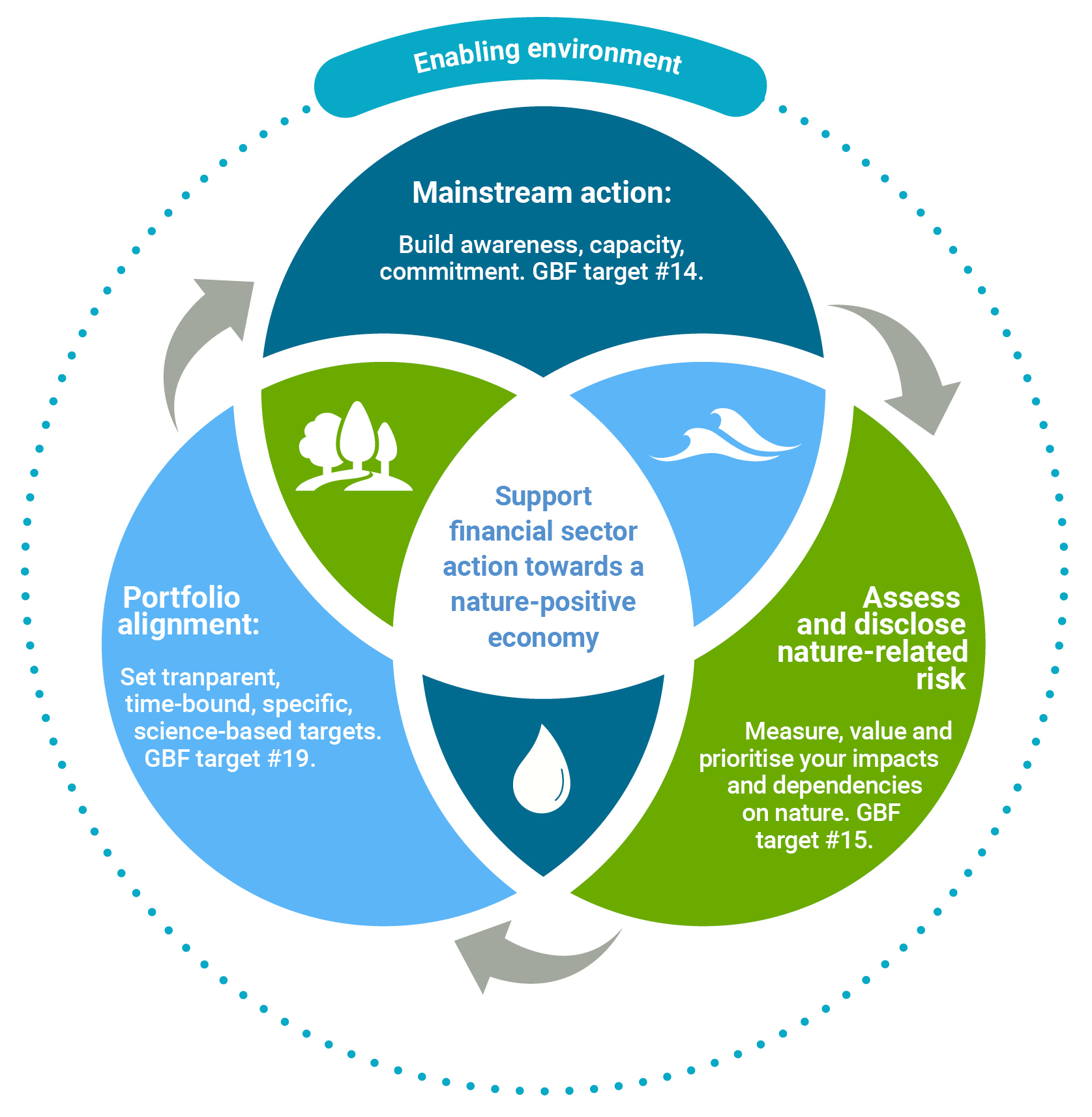

Our nature strategy, which complements UNEP FI’s strategy for 2022-2025, describes the work of the nature thematic that builds across various teams and within UNEP as a whole. The diagram below provides an overview of the strategy. UNEP FI members may also consult the strategy by visiting this page in the members area.

- Step 1: Analyse impact and dependency on nature at the portfolio level. Financial institutions can use tools such as ENCORE and the final recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD) in order to achieve this step.

- Step 2: Set robust targets, based on the outcomes of step 1, committing to ambitious, time-bound, science-informed targets to both halt and reverse the loss of nature, using the mitigation hierarchy. UNEP FI is currently working with the financial community to start setting targets, and has published guidance on biodiversity target setting. These targets are the starting point to measure impact and look at ways to eliminate impact by combining exclusion criteria, engagement, and opportunities to invest in nature-positive projects.

- Step 3: Report publicly on progress to ensure transparency and accountability, as is best practice in leading international frameworks such as the TNFD, Principles for Responsible Banking and the Principles for Sustainable Insurance. UNEP FI is a founding partner of the Taskforce on Nature-Related Financial Disclosures (TNFD) and is currently with financial institutions to implement the framework.

- PRB Biodiversity Community: Principles for Responsible Banking signatories are invited you to join the PRB Biodiversity Community, which is designed to take you from theory to practice in a few short months. Learn more by logging into the PRB Members Area…

- Webinar series: get inspired with our webinar series, ‘we need to talk about biodiversity,’ discussing the challenges and opportunities for finance and nature. Discover the series..

- Ocean finance: join our global community on Sustainable Blue Finance, which looks at how to sustainably engage in key marine sectors such as shipping, fishing, offshore renewables, coastal tourism, waste management, port constrution and more. Learn more…

- Food systems: how we produce and transport food remains one of the key contributors to global nature loss and the climate crisis. Learn more about how your organisation can tackle this critical area. Learn more…

- Forests & Land Use: We work with financial institutons on how their activities impact use of land resources, particularly in forested developing countries. Learn more…